Welcome to the First Part of Our Two-Part Series: Navigating the Ups and Downs of Economic Cycles

In the ever-evolving landscape of the global economy, understanding the nature of economic cycles is akin to possessing a roadmap through the financial world. These cycles, characterized by alternating periods of growth and contraction, impact nearly every aspect of our lives, from job availability to the prices we pay for goods. This first installment of our two-part series delves into the rhythms of economic cycles and the forces that drive them, laying the foundation for a deeper exploration of their effects and how we can navigate them in Part 2.

Understanding Economic Cycles

What Are Economic Cycles?

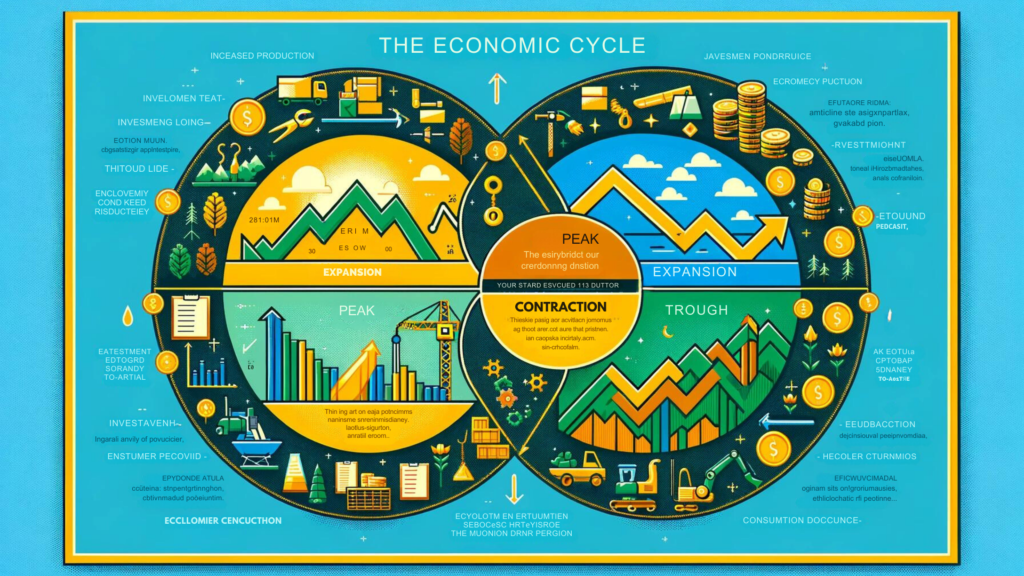

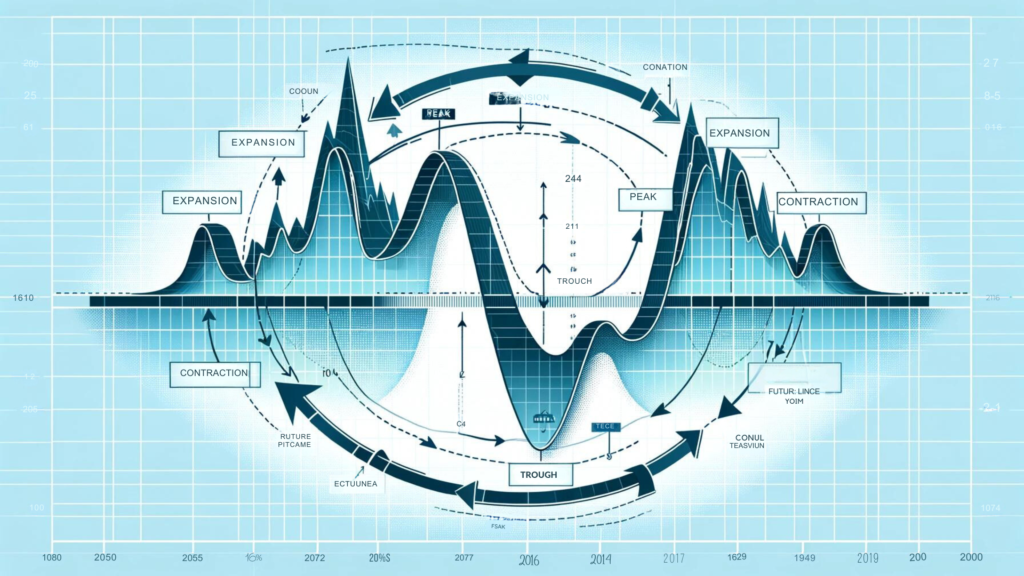

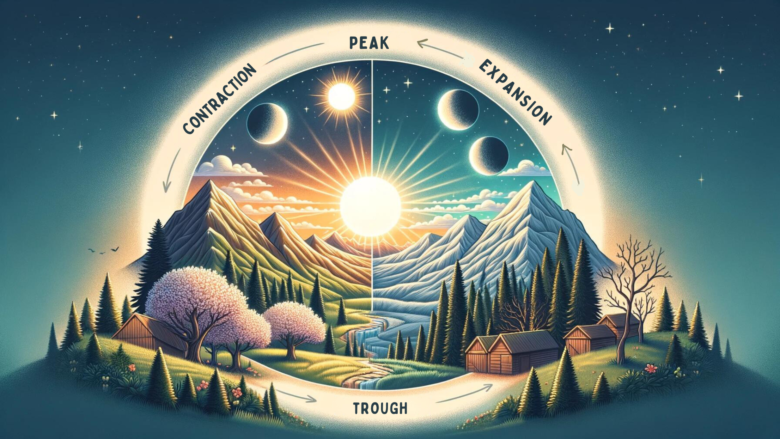

Economic cycles, also known as business cycles, are the natural fluctuations in economic activity within an economy over time. These cycles are segmented into four main phases: Expansion, Peak, Contraction, and Trough, each with its distinct characteristics and economic implications.

- Expansion: This phase is marked by rising economic activity. Key indicators such as Gross Domestic Product (GDP), employment rates, and consumer spending growth, signal a healthy, booming economy.

- Peak: The zenith of the cycle, the Peak phase indicates the height of economic growth before the transition to contraction begins.

- Contraction (Recession): Characterized by a decline in economic activity, contractions are periods where GDP decreases, unemployment rises, and consumer spending falls.

- Trough: The lowest point of the cycle, following a contraction. The Trough phase is the foundation from which economic recovery begins.

Each phase plays a pivotal role in the broader economic picture, influencing everything from corporate profits to individual financial well-being.

The Forces Behind Economic Cycles

External Shocks

External shocks are unforeseen events that drastically alter the economic landscape. These can range from natural disasters to geopolitical conflicts or pandemics, such as the COVID-19 outbreak, which disrupted global supply chains and consumer behavior worldwide.

Monetary Policy

Monetary policy, managed by central banks like the Federal Reserve in the United States and RBI in India, involves adjusting interest rates and controlling the money supply. These measures aim to either stimulate economic growth or cool down an overheating economy, thus influencing the cycle’s phase.

Fiscal Policy

Fiscal policy involves the decisions made by the government regarding taxation and expenditure. Through tools like tax cuts or increased public spending, governments can either fuel economic expansion or slow down an overheated economy to prevent inflation.

Business Investment and Consumer Confidence

The willingness of businesses to invest in new projects and the confidence of consumers to spend money are crucial drivers of economic cycles. High consumer confidence encourages spending, propelling economic growth, while cautious investment and spending behavior can signal or exacerbate a contraction.

Technological Innovations

Innovations can dramatically shift economic paradigms, creating new industries and job opportunities while rendering others obsolete. The digital revolution, for example, has transformed how we live, work, and conduct business, fueling economic growth in the process.

Conclusion: Setting the Stage

Understanding the ebb and flow of economic cycles is not just academic; it’s a practical necessity for policymakers, businesses, and individuals alike. Recognizing the signs of each phase helps stakeholders make informed decisions, from setting monetary policy to personal investment choices. In our next installment, we’ll explore the tangible effects of these cycles on our everyday lives and how we can navigate the inevitable ups and downs they bring.

Stay tuned for Part 2, where we’ll dive deeper into the impacts of economic cycles and strategies for resilience and growth in an ever-changing economic landscape.

Author’s Note

Thank you for joining me on this journey through the fundamentals of economic cycles. My goal is to demystify the complex world of economics, making it accessible and engaging to all. I look forward to sharing more insights in Part 2. Your feedback and questions are always welcome as we continue this exploration together.

G.C., Ecosociosphere contributor.

References and Further Reading

Comments

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.