Inflation is a term that echoes across the corridors of our economic landscape, touching the lives of everyone from the policy-maker in the government office to the family planning their budget at home. At its core, inflation represents the rate at which the general level of prices for goods and services rises, eroding purchasing power and reflecting the decreasing value of a currency. Understanding inflation is crucial, not just for economists but for everyone, as it influences key economic decisions, impacts living standards, and shapes the broader economic policy.

This blog aims to explain inflation, examining its mechanics, causes, and the profound impact it has on individual and collective financial well-being. Through this exploration, we aim to provide valuable insights into how inflation functions as an economic indicator and how it permeates various aspects of daily life and financial planning.

Understanding Inflation

Inflation is a fundamental economic concept that denotes the rate at which the general price level of goods and services in an economy increases over a period, leading to a fall in the purchasing power of money. It is often expressed as a percentage, indicating how much prices have risen over a year. At the heart of understanding inflation is the Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The CPI is a critical indicator used to gauge the cost of living and is a key measure of inflationary trends.

Other important measures of inflation include the Producer Price Index (PPI), which reflects the prices producers receive for their goods, and the Personal Consumption Expenditures Price Index (PCE), which measures the prices paid by consumers for goods and services without the fixed basket used by CPI. These indicators help economists and policymakers monitor inflationary pressures and make informed decisions.

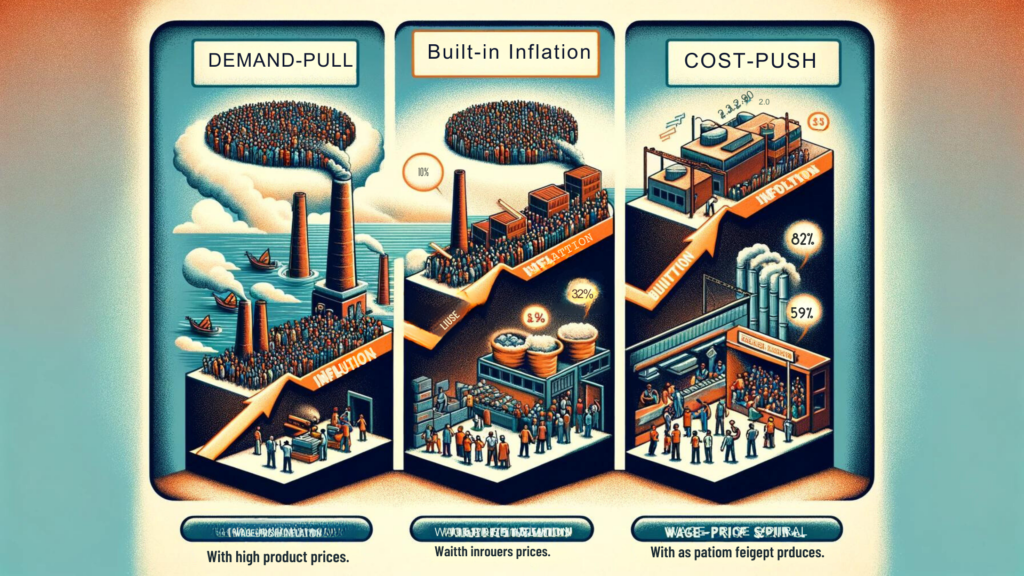

Inflation can manifest in different forms, with the most common being demand-pull inflation, which occurs when demand for goods and services exceeds their supply, pushing prices higher. Conversely, cost-push inflation arises when the cost of production increases (e.g., due to higher raw material costs), and producers pass these costs onto consumers in the form of higher prices. Built-in inflation, or wage-price inflation, occurs when workers demand higher wages to maintain their living standards in the face of rising prices. Employers then increase prices to cover higher wage costs, creating a cycle of wage and price increases.

Understanding inflation is crucial because it affects economic decisions, from individuals deciding how much money to save or spend, to businesses planning investments and pricing strategies, and governments formulating monetary and fiscal policies. A stable inflation rate is often seen as a sign of a healthy economy, as it suggests a balance between demand and supply, fostering sustainable economic growth and employment.

Causes of Inflation

Inflation arises from various sources, often categorized into three primary types: demand-pull inflation, cost-push inflation, and built-in inflation.

- Demand-pull inflation occurs when the aggregate demand in an economy surpasses its aggregate supply. This situation can arise from increased consumer spending, governmental expenditure, or investment, often driven by a booming economy, lower interest rates, or expansive fiscal policies. When more money chases fewer goods and services, prices naturally rise. For example, if a surge in consumer demand outpaces production capacity, companies will raise prices, leading to inflation.

- Cost-push inflation is triggered by a rise in the cost of production inputs like raw materials, labor, and capital. When producers face higher costs, they pass these on to consumers in the form of increased prices, thereby inflating the overall price level. An example of this would be a significant increase in oil prices, which not only affects transportation costs but also has a ripple effect across various sectors, leading to broader price increases in the economy.

- Built-in inflation, also known as wage-price inflation, stems from the adaptive expectations of workers who demand higher wages to maintain their living standards in response to rising prices. Employers, facing increased wage costs, may then raise their product prices to maintain profit margins, creating a wage-price spiral. This self-sustaining cycle can be difficult to break and can lead to persistently high inflation rates.

These causes of inflation are interconnected, and their impact can be compounded by external factors such as global economic trends, exchange rates, and geopolitical events, making the management and control of inflation a complex task for economic policymakers.

Impact of Inflation on Everyday Life

Inflation’s impact on everyday life is multifaceted, influencing various aspects of personal and economic well-being. One of the most direct effects is on purchasing power: as inflation rises, each unit of currency buys fewer goods and services, which can erode the standard of living. For individuals, this means that the money saved or earned does not stretch as far as it used to, affecting their ability to afford necessities and luxuries alike.

The effect on savings is another critical aspect. Inflation can diminish the real value of money saved in bank accounts or fixed-income investments, especially if the interest earned does not outpace the inflation rate. This scenario can lead to a decrease in the real wealth of savers over time. For example, if inflation is at 3% per year, but a savings account only offers an annual interest rate of 1%, the purchasing power of the savings will decline each year.

Inflation also influences interest rates, which are often adjusted upward by central banks to curb high inflation. Higher interest rates can make borrowing more expensive, affecting everything from consumer loans to mortgages and business investments. This can lead to reduced spending and investment in the economy, potentially slowing economic growth.

On the business front, companies face increased costs for raw materials, production, and borrowing, which can squeeze profit margins. Businesses may respond by raising prices, cutting costs, or reducing workforce, each of which has further ramifications for the economy and employment rates.

Moreover, inflation can impact economic growth and stability. Moderate inflation is often a sign of a growing economy, as it indicates rising demand for goods and services. However, if inflation becomes too high and uncontrolled, it can lead to economic uncertainty, reduced consumer and business confidence, and erratic investment patterns.

The interplay between wages and inflation is also crucial. In an inflationary environment, workers may seek higher wages to maintain their purchasing power, leading to wage inflation. While wage increases can initially offset the effects of inflation for individuals, if this turns into a wage-price spiral, it can perpetuate further inflation, creating a challenging cycle for policymakers to manage.

Inflation and Government Policy

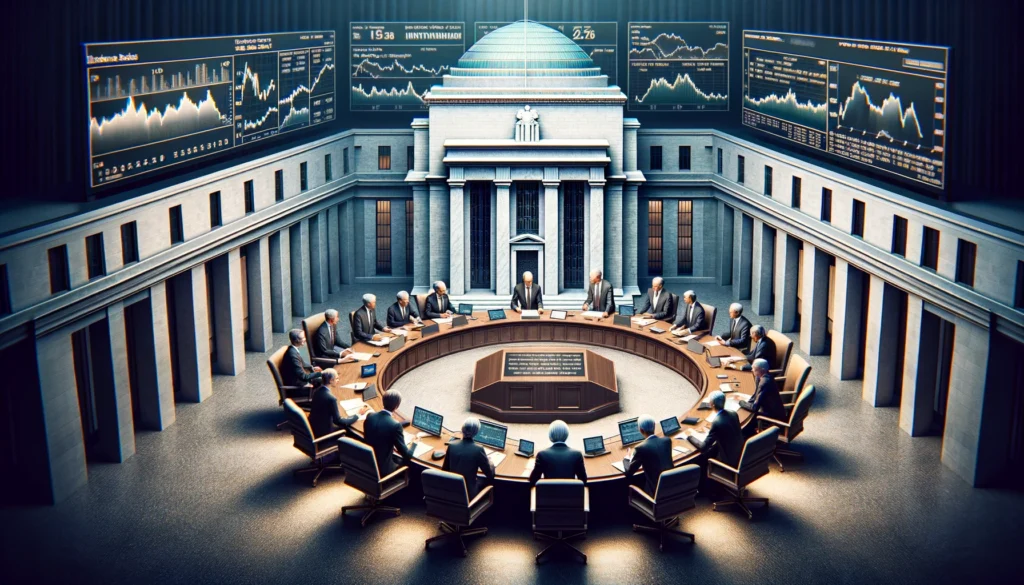

Government policy plays a crucial role in managing inflation, with central banks and fiscal authorities wielding significant tools to influence its pace and impact. Central banks, such as the Reserve Bank of India, primarily use monetary policy to control inflation. This involves adjusting interest rates and engaging in open market operations to influence the amount of money circulating in the economy. When inflation is high, central banks may increase interest rates to cool down economic activity by making borrowing more expensive, thereby reducing spending and investment. Conversely, if inflation is too low, indicative of weak economic activity, they might lower interest rates to stimulate borrowing, spending, and investment.

Central banks also use quantitative easing (QE) as a tool to manage inflation. QE involves the purchase of long-term securities from the open market to increase the money supply and encourage lending and investment. This policy aims to prevent deflation and promote economic growth, especially in times of financial crisis or recession.

Fiscal policy, executed by the government, is another powerful tool for managing inflation. It involves changes in government spending and taxation. During periods of high inflation, governments might reduce spending or increase taxes to decrease the money supply and cool off economic activity. This can help to control demand-pull inflation. Conversely, in a deflationary environment or during economic downturns, a government may increase spending or cut taxes to stimulate demand and economic growth.

Additionally, governments can implement supply-side policies to combat cost-push inflation. These include reducing regulations, investing in technology and infrastructure, and promoting workforce training to improve productivity and efficiency in the economy. By increasing the supply capacity of the economy, these measures can help control inflation without necessarily slowing down economic growth.

In managing inflation, governments and central banks aim to achieve a delicate balance, fostering stable economic growth while maintaining price stability. This task involves carefully monitoring economic indicators, anticipating future trends, and being ready to adjust policies in response to evolving economic conditions.

Coping with Inflation: Tips and Strategies

Coping with inflation requires a proactive approach to financial planning and decision-making, both for individuals and businesses. Here are some tips and strategies to mitigate the effects of inflation:

For Individuals:

- Invest in inflation-protected securities: Consider financial instruments like Treasury Inflation-Protected Securities (TIPS) or inflation-linked bonds, which adjust the principal and interest payments for inflation, safeguarding the real value of your investment.

- Diversify investments: Spread investments across different asset classes (stocks, bonds, real estate, commodities) to reduce risk. Stocks, for instance, can offer growth potential that outpaces inflation over the long term.

- Increase financial literacy: Understanding economic trends and financial planning can help in making informed decisions about saving, investing, and spending.

- Budget and save wisely: Focus on saving and investing a higher percentage of your income. A budget can help track and manage expenses, identifying areas to cut back if necessary.

For Businesses:

- Adjust pricing strategies: Regularly review and adjust prices to reflect increased costs and maintain profit margins without alienating customers.

- Improve efficiency: Invest in technology or processes that enhance operational efficiency, reducing production costs and offsetting inflationary pressures.

- Hedge against cost increases: Use financial instruments like futures contracts to lock in prices for key inputs, mitigating the risk of sudden cost increases.

- Focus on core strengths: Concentrating on areas of competitive advantage can help businesses maintain customer loyalty and operational efficiency, even in challenging economic times.

Inflation management is about balancing immediate needs with long-term financial health. By staying informed, planning, and adapting to changing economic conditions, individuals and businesses can navigate the challenges of inflation more effectively.

Conclusion

Understanding and managing inflation is essential for economic stability and personal financial well-being. By comprehending its causes, effects, and the mechanisms through which governments control it, individuals and businesses can make informed decisions to protect themselves against its adverse impacts. Effective strategies, such as diversified investments, efficient budgeting, and proactive pricing, can mitigate inflation’s challenges. Ultimately, staying informed and adaptable in the face of economic changes empowers us to navigate the complexities of inflation and maintain financial resilience in an ever-evolving economic landscape.

Author’s Note

As the author of this blog, I have aimed to shed light on the intricate nature of inflation and its pervasive impact on our economic and personal lives. I hope this piece not only educates but also empowers you to make strategic financial decisions amidst the dynamic economic environment we all navigate.

G.C., Ecosociosphere contributor.

References and Further Reading

- “The Inflation Myth and the Wonderful World of Deflation” by Mark Mobius – A book that challenges traditional views on inflation and explores its global dynamics.

- “Inflation: What It Is, Why It’s Bad, and How to Fix It” by Steve Forbes and Elizabeth Ames – Offers a comprehensive look at inflation’s mechanisms and practical solutions to combat it.