In the bustling markets of India, not all economic principles follow the straightforward paths laid out in textbooks. Some consumer behaviors defy basic laws of demand and supply, presenting unique challenges and opportunities for the common man. Today, we’ll explore two intriguing economic anomalies: Giffen Goods and Veblen Goods. These concepts may sound academic, but …

Public debt, a term often mentioned in the news but seldom understood deeply, is a crucial aspect of a country’s economic framework. For India, a burgeoning economy, understanding the dynamics of public debt is not just for economists or policymakers—it’s essential knowledge for every citizen. Why should you, the common man, be concerned about the …

When you hear economists and news anchors talk about the Consumer Price Index or CPI, you might wonder why this economic indicator gets so much attention. Simply put, the CPI measures how the average price of goods and services purchased by households changes over time—it’s essentially a gauge of inflation. Understanding CPI is crucial not …

Capital markets, often seen as complex financial arenas, are actually pivotal components of the economy, influencing not just the affluent but every stratum of society. In India, where economic dynamics play a crucial role in shaping the everyday lives of its billion-plus population, understanding these markets is not just beneficial; it’s essential. This blog aims …

When you hear economists and policymakers talking about the Gross Domestic Product or GDP, it might sound like complex financial jargon. However, GDP is more than just a number on a country’s economic scorecard. It’s a comprehensive measure that reflects the health of a nation’s economy and has a direct impact on everyday life. This …

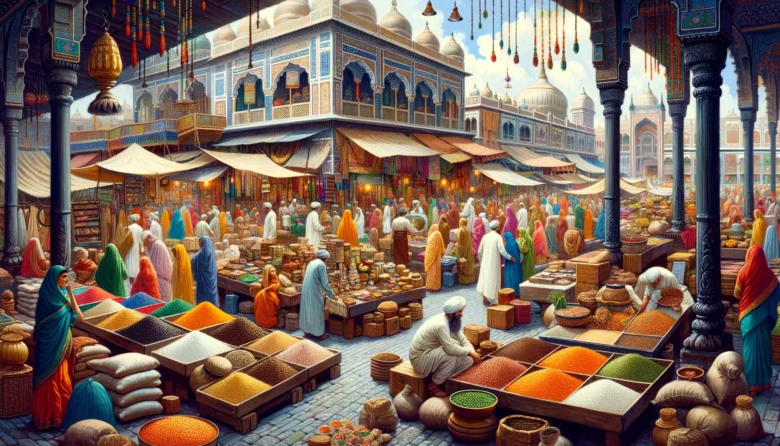

Imagine a bustling Indian market where buyers and sellers haggle over prices, striving to strike a deal. This scenario, a microcosm of the Indian economy, illustrates the concept of Market Equilibrium—a state where supply meets demand, creating a balance that affects everyone from street vendors to corporate moguls. But why should the average person care …

Have you ever wondered why loan interest rates fluctuate or why your savings account interest rates change? The answer often lies in a term you might have heard in the news: the repo rate. It’s a tool that the Reserve Bank of India (RBI) uses to control the flow of money in our economy. Understanding …